Dive Brief:

- Leading CRM provider Salesforce announced Monday it had agreed to acquire Tableau, a staple of the data visualization market, in an all-stock deal valued at $15.7 billion.

- The acquisition from Salesforce is its biggest one to date. In connection with the deal, the San Francisco-based company plans to make Seattle its second headquarters, Business Insider reports.

- As Tableau gets folded into Salesforce's Customer 360 software suite, analysts agree the move will cause overlap with Salesforce's Einstein Discover tool.

Dive Insight:

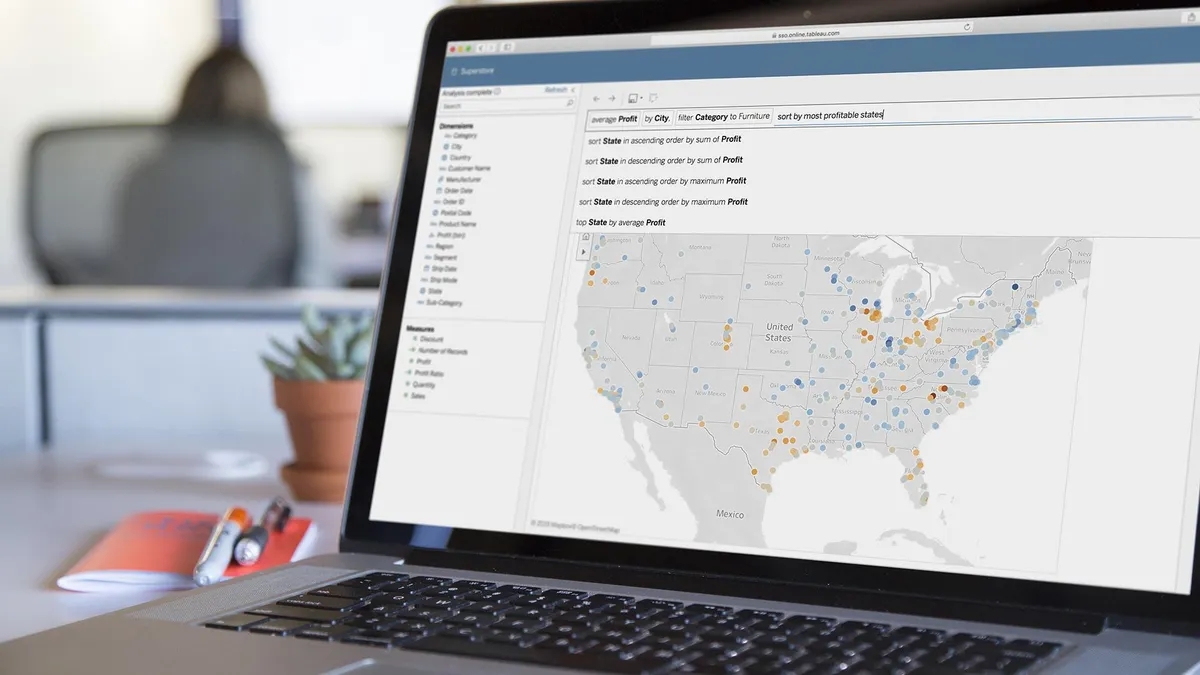

The Tableau acquisition is the latest move from Salesforce, a front-runner of the CRM field, to strengthen its stance in the data analytics and business intelligence fields. Or, as Salesforce would say, the "$1.8 trillion digital transformation space."

In March of last year, Salesforce dished out $6.5 billion for API management tool Mulesoft, a move that sought to ease the integration of data from enterprise software tools.

Now, by adding a well-regarded player in the data visualization space, Salesforce can further connect a sizeable and passionate customer base, said Joe Antelmi, an analyst at Gartner.

"That said, it does introduce an overlap," Antelmi said. "Salesforce competed with Tableau with its Einstein Discover product. The buyer for Einstein were customers that were already very embedded with Salesforce and wanted to add augmented analytics. With Tableau, they are positioned with customers that are looking for an end-to-end platform."

In a mature market like business intelligence, one marked by commoditization and notable price pressures, acquisitions like Tableau's by Salesforce or Looker's by Google Cloud are unsurprising, said Boris Evelson, an analyst at Forrester.

"An independent vendor can't continue to survive," said Evelson. In the case of Tableau and Salesforce’s Einstein Discovery, this was especially true given their overlap in functionality.

"It will be interesting to see whether they keep Tableau as a separate product or will they bite the bullet and do an overhaul to merge the two products," said Evelson.

Salesforce has a track record of smooth transitions after acquisitions, as evidence by its purchase of MuleSoft (which is now Salesforce Mulesoft) and its 2016 acquisition of data analytics tool BeyondCore. The challenge for the company will be to handle a much larger acquisition without losing its focus.

"Today tableau does nothing but BI and analytics, while Salesforce has multiple lines of service," said Evelson. "Losing focus is always a danger."