Dive Brief:

- Over half (55%) of companies are spending more than they did last year on cloud computing, with nearly a quarter (24%) describing it as a “significant increase,” according to research conducted by London-based Vertice, a cloud and software-as-a-service spending management company.

- The study found that 55% of finance leaders blame out-of-control cloud spending on a lack of transparency from tech leaders, with 44% saying they can't get visibility into costs.

- “These finance teams see cloud spend going up, but they don’t also know why, and they have no forcastability,” Vertice CEO Eldar Tuvey said in an interview.

Dive Insight:

A company’s use of cloud-related services tends to be scalable along with the associated costs, which can result in sticker shock at billing time if not carefully managed, according to Vertice.

“More product, more features, more development, more customers, more services, more analysis: it all results in increased costs,” the report said. Only 5% of companies reported cloud costs being lower than they were in the previous year, while 1% claimed to have reduced these costs significantly.

Finance leaders are almost three times as likely to be concerned about cloud costs than their tech peers, and more than twice as likely to be worried about getting visibility into the cloud, the research found.

Vertice surveyed 600 U.S. and U.K. finance and tech leaders in August. The startup recently expanded its focus beyond SaaS spending management with the launch of a new cloud cost optimization platform.

Worldwide cloud infrastructure services spending rose 16% to $72.4 billion in the second quarter of the year, down from 19% in the prior three-month period, as macroeconomic uncertainties have forced customers to remain focused on optimizing cloud usage to rein in costs, according to a report published last month by technology market analyst firm Canalys.

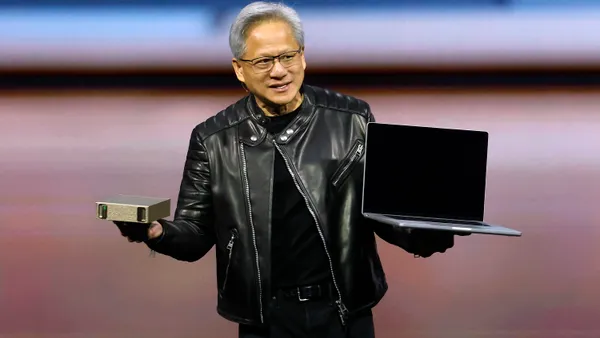

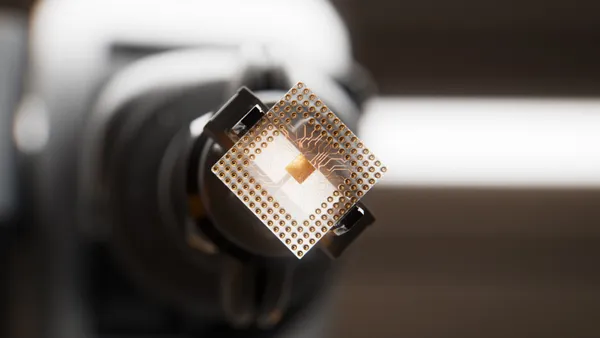

“In the current business landscape, where emphasis is placed on cost control, cloud vendors must secure a significant influx of new customers and workloads to drive revenue growth,” the report said. “The emergence of AI [artificial intelligence] technology is introducing new cloud workloads and is set to fuel massive demand for computing capacity, creating new opportunities for cloud growth.”

So far, AI technologies and their integration into existing products have yet to see widespread commercialization, “so have not had a meaningful impact on revenue for the cloud providers,” according to the Canalys research.

Meanwhile, major players in the industry have announced pricing adjustments as they grapple with inflation and higher operating costs. The list includes cloud infrastructure companies Google, Microsoft and IBM as well as SaaS provider Salesforce.