Dive Brief:

-

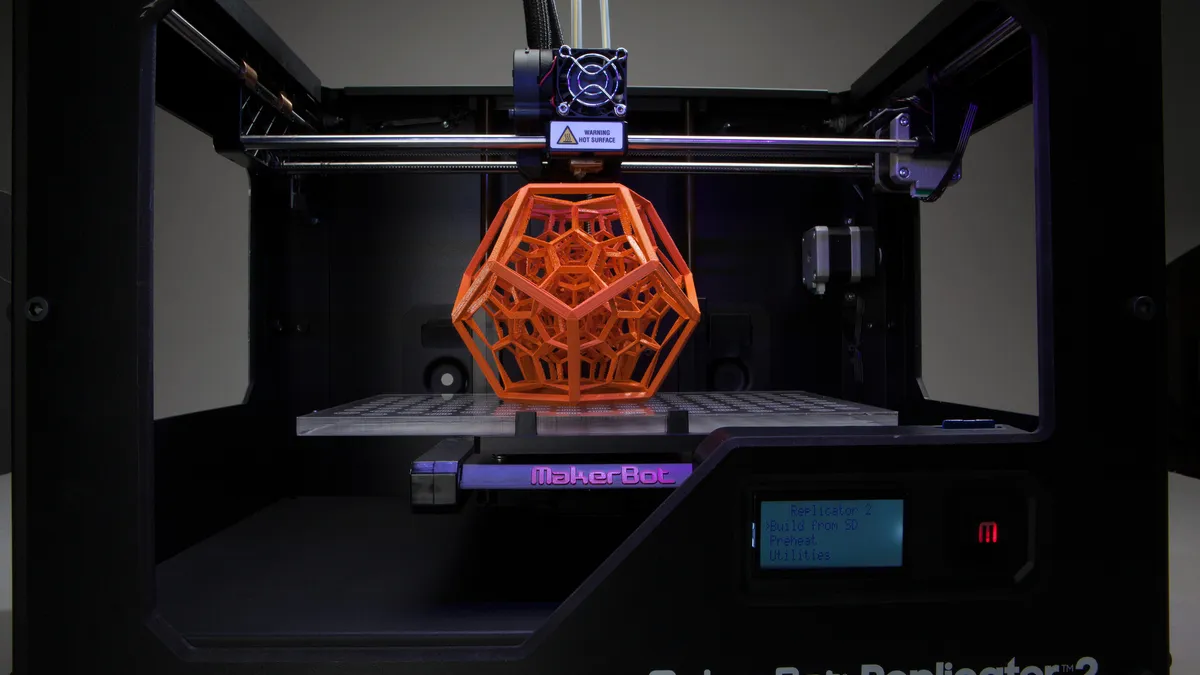

HP Inc. and Deloitte announced plans to work together with companies interested in using HP's 3-D printers for manufacturing, according to Fortune.

-

HP is looking to become a significant player in the $12 trillion 3-D printing market, according to Dion Weisler, CEO of HP Inc. Deloitte's interest in the market has grown because improved tech and cheaper materials have made 3-D printing more economical.

-

The two companies have a history of technology partnerships. HP has also partnered with other big-name companies such as Johnson & Johnson, BMW and Siemens to sell and improve its 3-D printers, according to Fortune.

Dive Insight:

HP is still a relative newcomer to the 3-D printing market, having only entered last December. But it sees great potential for manufacturing companies needing small amounts of highly customized parts.

Deloitte has had a consulting group dedicated to manufacturing for many years, so it knows how to navigate the market and has a long list of customers that could soon become HP Inc. customers as well.

Manufacturing is seen as a key market for specialized, high-end technologies like AI, wearables like Google glasses and 3-D printing. These technologies offer companies an edge in a competitive business where tight margins are the norm.

Hewlett Packard split into two companies in November 2015 — HP Inc., focused on printer and personal systems, and HP Enterprise (HPE), focused on businesses. Since then, business has been good at HP Inc.

The company's second quarter 2017 net revenue was $12.4 billion, up 7% over the same period the year prior. Company executives have chalked it up to the abilities to better focus on business and to accelerate the pace of innovation.

HP Inc.'s success has come as a bit of a surprise as its competitors have struggled with hardware sales and weaker consumer demand for technology overall. HP Inc. is trying to appeal to market changes, and the shift away from traditional personal computing and towards 3-D printing is part of that effort.

The split has not gone as well for HPE, however, where Q2 revenues were down 13% compared to the same quarter last year. HPE revenues have declined steadily for the last three quarters.