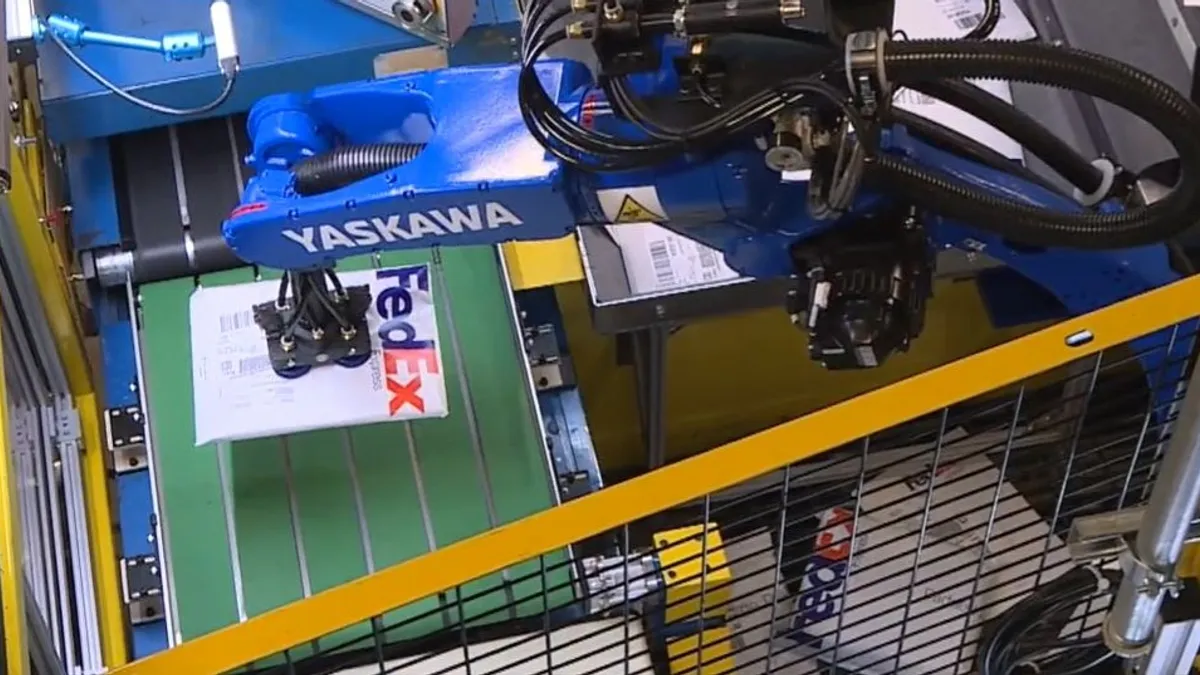

An average-sized package traveling through one of FedEx Ground's automated facilities requires human contact at only two points: unloading and loading.

"When they're taken off the truck on the unload side, they go through the conveyors and through the whole sortation system," Ted Dengel, FedEx Ground managing director of operations technology and innovation, said in an interview. "Then, they get loaded onto a trailer on the other side for the second touch."

FedEx Ground has more than 150 fully automated facilities in its network after adding 16 ahead of the peak holiday shipping season. Fewer steps involving manual inputs are vital for the company to keep service levels high amid a challenging labor environment and a boom in e-commerce volume since the COVID-19 pandemic began. FedEx as a whole is expected to deliver 100 million more holiday packages than in 2019.

But some of these packages won't be able to travel through a fully automated sortation system due to their unwieldy dimensions. As consumers become more comfortable ordering anything and everything online, FedEx is encountering more oddly-sized items like furniture, tires and televisions that don't mesh well with its automated facilities.

"Robotic arms do the same thing over and over and over really well," Dengel said. "But in our world, every transaction is almost a different challenge for the robot. So we started looking at other ways on how to combine bulk material handling and some robotics to try and get the throughput we needed to match what humans could do, as well as to handle the variability."

FedEx's recent automation investments targeted what Dengel calls the package bell curve. The majority of the carrier's volume that constitutes the middle of the curve can be handled through automated sorters. But the ends of the curve — the smallest and largest-sized packages — have always been handled in a more manual fashion.

FedEx's recent automation investments

| Investment | Description |

| Robotic Product Sortation and Identification systems | The systems from Berkshire Grey, stationed at FedEx Ground facilities in Queens, Columbia and Las Vegas, sort thousands of small packages daily into containers bound for other hubs and stations. |

| Small Package Sort System robotic arms | The arms, installed at the FedEx Express World Hub in Memphis, streamline the repetitive sorting process for small packages and letters and can sort between 1,000 and 1,400 packages per hour. |

| Small Package Sort System mobile robots | These warehouse robots move packages that can’t be processed due to being the wrong size, having the wrong address or being damaged to the appropriate area for handling. They are being tested at FedEx Express facilities. |

| STAX mobile robots | These robots move both large and small packages around a warehouse. They are being tested at FedEx Express facilities. |

These investments allow FedEx to redeploy its employees into other facility areas, giving it more operational flexibility in a time of high shipping demand. Berkshire Grey's Robotic Product Sortation and Identification systems, for example, match the human throughput of roughly 1,000 packages sorted per hour while also being "practically 100% accurate" in their sortations, Dengel said.

The consistent efficiency of warehouse robotics, spikes in demand and difficulties hiring enough frontline workers is accelerating interest in automation since the pandemic took hold.

"Now at least when I hear about warehouses and robotics, it's a very immediate short-term mindset to fulfill a very immediate need with the labor shortage," said John Seidl, a partner at GreyOrange, in October. "The mindset of a lot of your clients nowadays is pretty different than what it was earlier."

FedEx rival UPS is also pushing for greater automation in its network. Employees who load UPS' delivery vehicles will use wearable devices to eliminate 20 million manual scans a day, CEO Carol Tomé said on the company's Q3 earnings call.

"When you think about the cool technology that we're going to introduce into our buildings — automated label application, automated bagging, robotic induction into the package cars — there's just a ton of opportunity here to drive automation in ways that we haven't done before," Tomé said.

Greater levels of automation will help UPS and FedEx handle the deluge of packages more effectively. However, this can also introduce limitations within facilities when volume levels peak.

Automated facilities tend to have "a plateau you cannot exceed," said Todd Benge, senior vice president of parcel operations at Transportation Insight, in an October webinar. This means they can't simply add more employees to increase the amount of packages they can handle per hour.

"The best thing to try to do as a customer is forecast the volume ahead of time and get it to the carriers and make good communication with the carriers" to see if they can meet the level of service required, Benge said.

FedEx works closely with its largest shippers to anticipate volume surges and avoid capacity constraints ahead of the busiest shipping days, Dengel said. The company's facilities also have ways to bolster their sortation capabilities — they can extend package sortation periods at its facilities, reduce the hours between sorts and run more of them if warranted, he added. FedEx can push less time-sensitive deliveries to later sorts that aren't overwhelmed, as well.

"Really it's more about expanding the hours that we operate in a day as opposed to trying to cram more packages through a system that's already at capacity," Dengel said.

Beyond further robotics capabilities to better handle small and large packages, FedEx Ground is exploring ways to automate the trailer loading and unloading process, the only manual steps left for the core of the company's package volume.

"It's very tricky getting various kinds of packages on and off of a trailer in an autonomous fashion, so we're looking at different solutions there," Dengel said. "That's where I can see things going in the next five to ten years is really trying to solve those problems as well."