As digitization transforms the restaurant industry, major chains and independents alike are clinging to data mining as their key to success on this new playing field. There's just one problem: few businesses know what to actually do with it.

"Every number is a clue about how to do better," Hope Neiman, CMO for digital ordering software company Tillster, told Restaurant Dive. "Sometimes you have to use your gut and see how data plays out because you know your brand better than anybody."

The gut check is pointing many foodservice heavyweights — and as a result, the rest of the industry — toward the same goal: personalization.

McDonald's $300 million acquisition of personalization and decision logic technology firm Dynamic Yield is perhaps the splashiest confirmation of the sea change. The fast food titan will use its new tech to launch digital drive-thru menus that can react to time of day, trending menu items, restaurant traffic and weather.

And just this month, Sonic announced it will be the first restaurant to test new artificial intelligence-powered, voice-assisted technology from Mastercard and kiosk vendor Zivelo at its drive-thrus to bring diners customized menu experiences.

But data's potential stretches far beyond drive-thru personalization. These insights can help improve everything from restaurant policies and menus to advertising campaigns and staff training. Getting from point A to point B, however, is easier said than done.

Because of this, the number of third-party delivery, reservation and POS system platforms offering to hone this information for their restaurant clients continues to grow. Small eateries enter partnerships to scale technology and deepen their knowledge of diners faster. But many of these deals involve surrendering ownership of the very data restaurants want to learn from, a risk some in the industry posit is too great.

"I think the third party is ultimately destroying the brand… you have data hogs out there," said Steve Holmes, co-founder of scheduling and recruiting platform company ShiftPixy, in an interview with Restaurant Dive. "If you own the data you own the relationship."

Balancing the risks of data control and optimization

Much of the industry's worries about data ownership has centered on the rise of third-party delivery platforms, which Holmes equates to a Trojan horse for companies looking to advance.

Nieman said that instead of partnering with the likes of Uber Eats, Postmates or DoorDash, restaurants should offer delivery through their own websites to collect customer data and trace diner trends, providing targeted marketing to a range of consumer types.

Reservation websites have also come under fire for their relationship with client data. OpenTable's partner restaurants do not own their corresponding data, the company's CEO Steve Hafner told the Wall Street Journal. The platform updated its client agreement to protect diner privacy — though restaurants and reservation system SevenRooms have complained the move is meant to block knowledge sharing.

"We're morally and legally obligated to protect everyone's privacy interests. We can't stand by while third parties systemically harvest data from our systems without adequate user consent," Hafner wrote in an email to OpenTable users.

Some argue these integrations, and the strings that may come with them, help restaurants avoid overwhelming staff with tasks that lie beyond their job description.

"We know that a general manager of a restaurant isn't an analyst," Dan Dillon, vice president of U.S. operations for Yumpingo, told Restaurant Dive. "Expecting a general manager to go into a dashboard and toggle and cross-reference to look at it by menu category, menu item, by daypart, by server… that's not their forte, nor should it be."

To keep these employees out on the floor instead of behind a desk, Yumpingo built an insights tool that funnels information managers need to know for the week to them based on the previous week’s performance and current opportunities, Dillon said.

"When a human is involved in bookkeeping, they're just keeping up. Ninety percent is just getting data in. Ten percent is looking at what it means," Enrico Palmerino, CEO of automated bookkeeping platform botkeeper, said during a panel at the NRA Show. "[Automation] helps them get out of the weeds."

Review sites are upping their data offerings, as well. Yelp's director of business outreach Darnell Holloway said at the NRA Show, for example, the platform is no longer just a review site but a data mine thanks to the 1.8 billion searches it has amassed online.

"When a human is involved in bookkeeping, they're just keeping up. Ninety percent is just getting data in. Ten percent is looking at what it means. [Automation] helps them get out of the weeds."

Enrico Palmerino

CEO, botkeeper

Yelp business outreach manager Emily Washkovick told Restaurant Dive the company's data processing capabilities can provide restaurants with predictive analysis that can get them ahead of major food trends, such as poke bowls and plant-based burgers, before they become entrenched in certain markets.

By updating menus accordingly, restaurants have found success through Yelp, Washkovick said.

Some platforms are actively trying to improve data-sharing relationships between restaurants and third-party partners. eTouchmenu, a digital menu solutions service, deletes restaurant data from its system and sends it to the restaurant when a company ceases to be a client, John C. Wolfe said, founder and CEO of eTouchmenu parent House Advantage, told Restaurant Dive.

But this isn't a common practice in the industry.

"Dialogue has really got to evolve to what data could do to a business and how dangerous it is to have in other hands that aren't aligned with your goals," Wolfe said. "Protecting the data means protecting a company’s upside."

How much diner data is too much?

Much of the concern over data ownership today is centered on how third parties could use this knowledge to directly compete with restaurants in the future.

Holmes suggested that these platforms could use what they've learned from restaurant clients' diners to develop their own competitive menu items, and said he wouldn't be surprised if there are one day "Grub burgers" and "Uber burritos" being marketed on these platforms.

"When they can create products to cater to [customer preference], that is scary, like what Amazon is doing in retail," he said. "It's a really scary thing if you're in that business."

Toast co-founder and president Aman Narang told Restaurant Dive that over the next five years, restaurants will collect even more data about their guests through a growing number of ordering touchpoints. The question is, he said, how businesses will make this heap of data productive and actionable in a way that is meaningful to both diner and restaurant.

"You don't want to get text messages from every restaurant you go to. That's too much," he said. "[Restaurants] have to figure out how to make that data productive … for guests at the end of the day."

OpenTable's Chief Technology Officer Joseph Essas told Restaurant Dive that the company has grappled with a similar quandary as it delves deeper into data analytics capabilities.

"That balancing act between creepy and hospitable — that's where we're trying to play," he said.

Deeper data honing requires strong commitments to protection and privacy, as diners are already sensitive to the threat of breaches, Essas said.

In the past two years, Panera, Applebee's, Cheddar's Scratch Kitchen, Chipotle, Wendy's and Arby's have suffered major hacks. According to a report from cybersecurity firm Shape Security, between 80% to 90% of consumers who log into a retailer's e-commerce site are hackers using stolen account credentials.

"That balancing act between creepy and hospitable — that's where we’re trying to play."

Joseph Essas

CTO, OpenTable

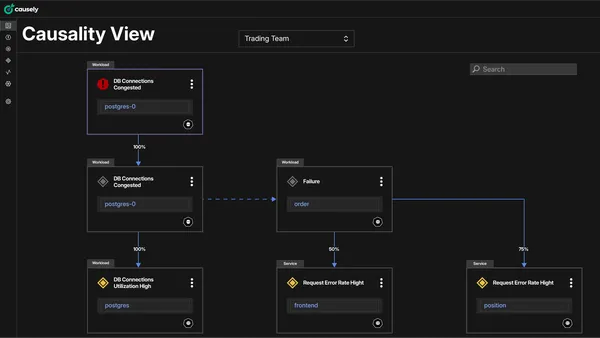

In the coming years, it is likely restaurants will increasingly embrace artificial intelligence, as McDonald's and Sonic have done, to improve data collecting capabilities. AI can help restaurants consolidate data from many systems and yield better reporting, analytics, budgeting and forecasting, Palmerino said.

Though much of this tech has been relegated to major industry players thus far, AI can help level the playing field for smaller restaurants as well, Narang said.

Even without the most sophisticated data mining technology, restaurants can build strategies from these insights to drive loyalty, monitor store performance, create segmented and hyper-specific marketing strategies and make informed decisions about market expansion, Neiman said. These moves will become increasingly vital to survival in today's cutthroat restaurant space.

"Those that know how to use [data] can drive growth," Wolfe said. "They can drive more reliable execution of the business. It is incredible what you can do with your data and just cement your relationship with your customer."

Julie Littman and Thai Phi Le contributed to this report.