Dive Brief:

- Global investments in data centers surged 51% year over year in 2024 to $455 billion, according to research published Wednesday by Dell’Oro Group. The firm expects infrastructure capital expenditures to grow an additional 30% this year.

- Much of the spending went into cloud vendor capacity expansions, the analysis found. "The top 10 hyperscalers accounted for more than half of global data center CapEx in 2024, driven largely by heightened investments in AI infrastructure," Baron Fung, senior research director at Dell’Oro Group, said in an email.

- The three largest hyperscale providers — AWS, Microsoft and Google Cloud — are in the midst of an ongoing data center spending spree, pouring tens of billions of dollars into infrastructure to satisfy escalating demand for high-capacity AI compute. At the current growth rate, Dell’Oro expects capital expenditures to surpass $1 trillion annually by 2029.

Dive Insight:

The generative AI boom affected the technology ecosystem from the top down, mobilizing massive investments in cloud infrastructure and driving available data center capacity to new lows last year.

Enterprises felt the pinch as rental rates for colocation facilities spiked in Northern Virginia, Atlanta and other key markets, according to commercial real estate firm CBRE. Organizations that failed to secure leases in advance faced highly constricted market conditions, Gordon Dolven, director of Americas data center research at CBRE, told CIO Dive last month.

A big chunk of last year’s infrastructure spending — 36% — emanated from three cloud behemoths, AWS, Microsoft and Google, according to Dell’Oro group. But banks, insurers, manufacturing companies and other businesses weren’t far behind.

Enterprises increased hardware and infrastructure spend by 25% year over year to $150 billion in 2024, the largest growth rate Dell’Oro has seen since the firm began tracking the market in 2014. Second and third tier cloud providers, including xAI and CoreWeave, accounted for most of the additional spending.

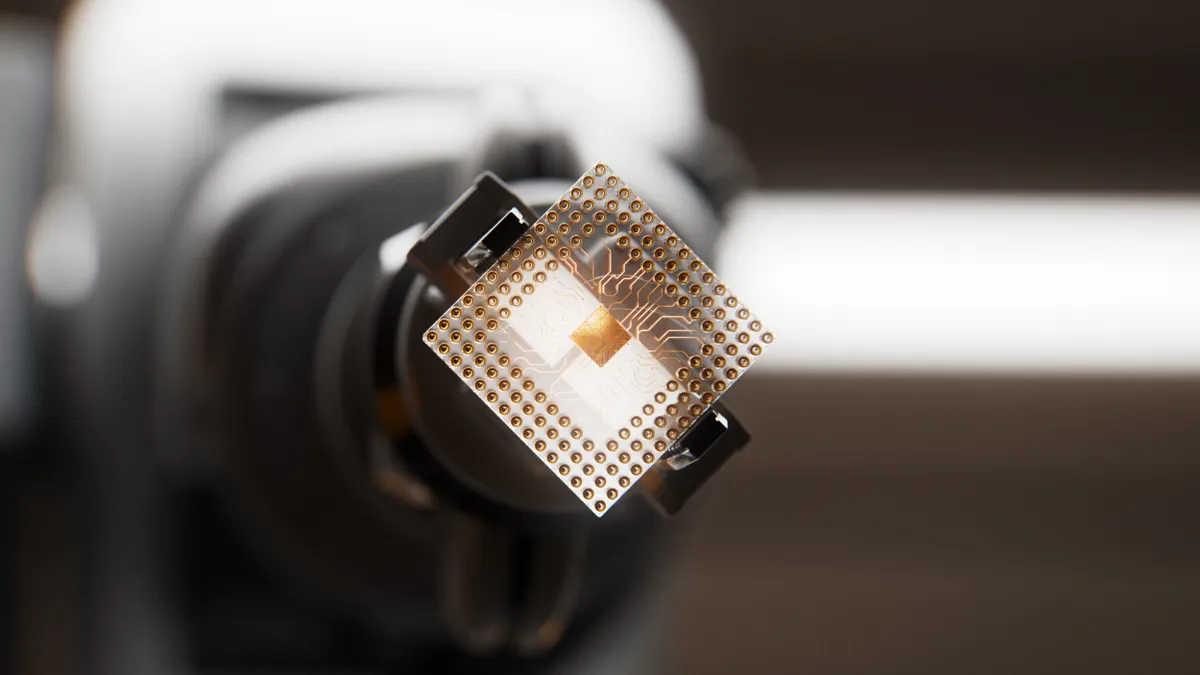

Enterprises and smaller cloud providers procure data center hardware from the branded vendors, Fung said. AWS, Microsoft and Google have each developed proprietary chip technologies to run AI workloads.

Nvidia remains the dominant force in the market for commercially available AI processors. The semiconductor giant accounted for over 90% of GPU server shipments in the Q4 2024, according to IDC research published Tuesday.

Revenue for servers with an embedded GPU nearly tripled year-over-year in Q4, as the total market for servers grew 91% to a quarterly record of $77.3 billion. Overall, servers racked up $236 billion in sales last year, IDC said.

“The growth we are experiencing in the server market is mainly driven by large data centers building their AI infrastructure,” Lidice Fernandez, group VP of Worldwide Enterprise Infrastructure Trackers at IDC, said in an email. In Q4, revenue for servers with GPUs surpassed traditional CPU server revenue, accounting for nearly two-thirds of the market, Fernandez said.

Dell’Oro saw evidence of non-hyperscale AI hardware investments as accelerated servers sold by Dell, HPE, Supermicro and other manufacturers comprised more than two-thirds of total server revenue in 2024.

The firm cautioned that economic uncertainties could curb IT spend in the coming year, and hardware supply constraints might affect enterprise data center investments.