There's no single way for a company to undertake a digital transformation, but for the effort to be successful, the CFO and CIO must work together, executives who've gone through the process said Friday in a CFO.com webinar.

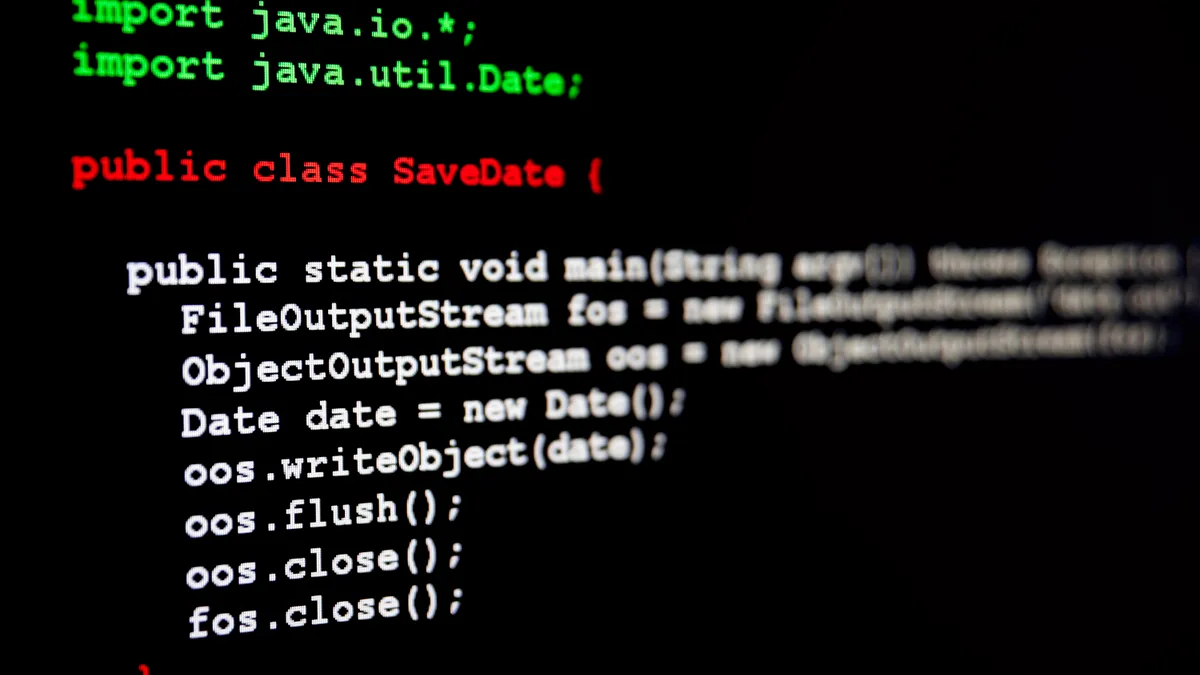

Matt Reece, CFO of Webcor, a San Francisco-based construction company, credits the CIO for taking the lead on an effort to collect, manage and interpret the massive amounts of data the company collects as part of its digital transformation. "It was done through a prescribed process — building the flows, getting it into a wireframe, getting it tested, piloting different things, and making sure the training was done properly."

Worldwide Environmental Products, a transportation safety and emissions technology company in Brea, California, took the opposite approach: the company's CFO led the process, and the IT team provided support.

"[Worldwide's] CFO brought in a schoolmate from his master's program, who is a specialist in finance and data, and that person basically became our chief data scientist," CIO Stephen Alford said. "That was great for me, because that's a fairly new area for us on the infrastructure side."

Reece said he and the CIO of his company talk informally every day and meet formally once a week to make sure their company's technology investments stay on track. "We have to stay in communication to make sure our actions are aligned," he said.

For the most part, digital transformation means digitizing finance, accounting and other operational functions, enabling mobile and other remote access to the technology infrastructure so staff can work untethered to a computer, and moving away from premise-based software to cloud-based platforms to accommodate the huge new inflows of data that's generated.

For all the promise of these projects, the CFO and CIO's collaboration are crucial for quantifying the value of the new processes by measuring both the tangible — the new business and reduced costs — and intangible benefits.

"We looked at the value in organizations that are harder to measure," said Amir Jafari, general manager of ServiceNow, a cloud computing company. "How do we just give time back, the most precious commodity for all of us?"

The workflow at his company improved once his staff was able to access their work from their phone, Jafari said. Mobile access enabled "us to not miss soccer games or to be with our families," he said. "All of these things taken together is how we started looking at specific projects."

Partnership can speed adoption

Because of their sweeping scale, company leadership must buy in to digital transformation projects before they can count on their staff to embrace the required change, the executives said. By working in tandem, the CFO and CIO can help expedite the buy-in, with the CIO identifying technology and the CFO bringing in vendors at the best cost.

"My CFO is really good at leveraging vendor partnerships to get price breaks," Alford said. "The CFO can then spend more [time] moving forward with the latest technologies."

Even under the best leadership-driven initiatives, change is hard for staff because it takes them out of their comfort zone, which is a particular problem for finance and accounting staff long accustomed to working with Excel spreadsheets.

One of the selling points for them, then, is accessibility: the ability to access their work remotely and know they're working on the same version everyone else is. That's something the CIO is well-positioned to articulate to staff.

"I've been working with the CIO to move us away from a place where that data ends up in a silo, a place that only a select group of people can access because it's stored on that individual shared drive or on Excel," Reece said.

Bottom line: Whether it's the CFO or CIO taking the lead on digital transformation, both serve their company best when they collaborate to identify the technology they want, sell it to leadership and staff, implement it, and then measure its value.

Editor's note: ServiceNow is a sponsor of the webinar.