Dive Brief:

- Broadcom announced its "best and final offer for Qualcomm" Monday, upping the price per share to $82. Qualcomm shareholders would receive $60 of this in cash and the remaining in the form of Broadcom shares so they can "share in transaction benefits." Broadcom expects the deal to be consummated within 12 months of signing an agreement and is ready to pay a "ticking fee" if it is not.

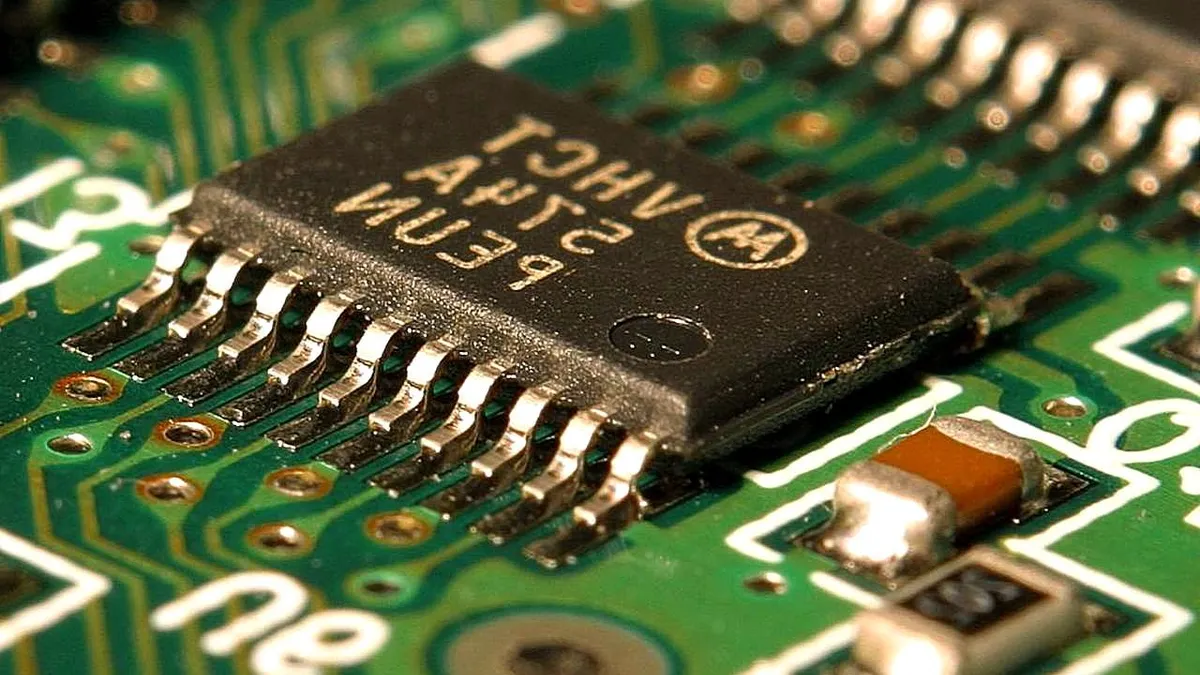

- The deal would come in at more than $121 billion and would mark the largest technology deal to date, reports The Wall Street Journal. The two companies combined would become the third largest chip maker by revenue, following Intel and Samsung.

- Broadcom promised to pay a "significant reverse termination fee" if it does not receive regulatory approval for the deal. Break-up fees are typically 3% to 4% of a deal, but Broadcom is planning to pay higher, reports Reuters.

Dive Insight:

Qualcomm's board unanimously rejected an "unsolicited" Broadcom proposal in November on the grounds that it greatly undervalued the company. The company sent a letter to stockholders in late January advising them against "Broadcom's hostile takeover proposal."

The company's highly profitable patent licensing business is still tied up in a well-publicized legal dispute with Apple and its contract manufacturers. This dispute negatively impacted Qualcomm's Q1 2018 earnings, in which operating income was down 96% year-over-year and down 91% since Q4 2017.

Besides Qualcomm's reservations, many experts have expressed worries about antitrust problems should the deal go through. The deal would offer Broadcom space to expand its products into the 5G market, which Qualcomm is pursuing.