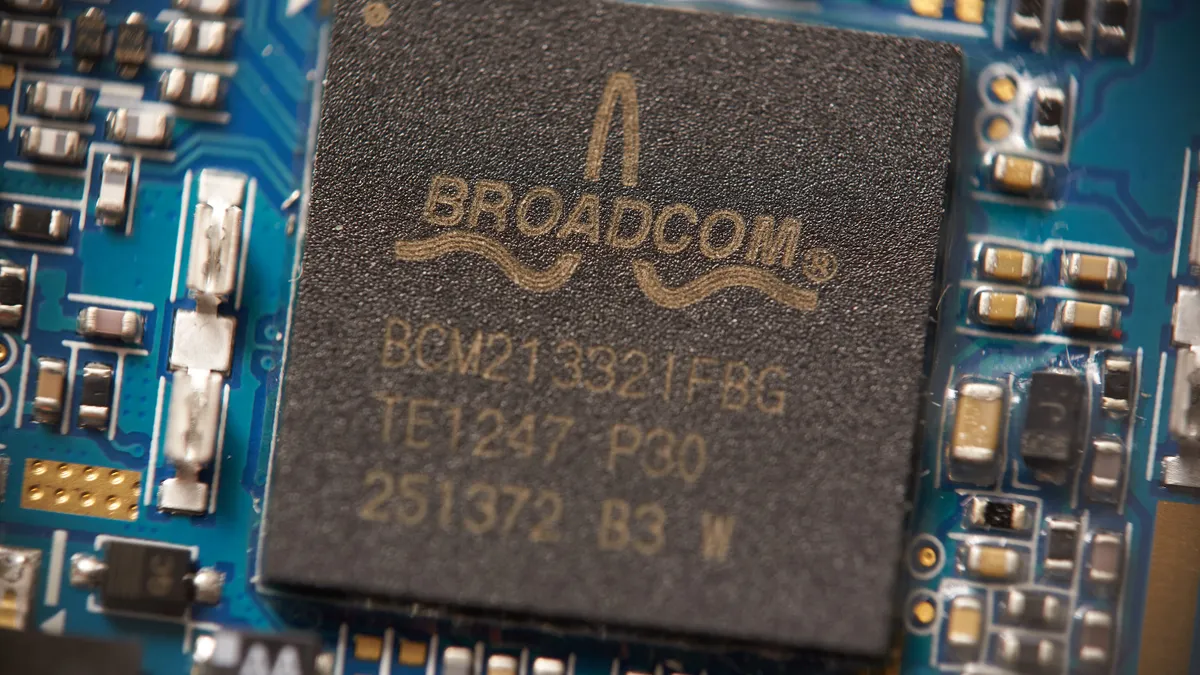

One year ago, the enterprise technology market shuddered as Broadcom swallowed up VMware. Customers were right to worry.

The semiconductor giant’s $61 billion acquisition of the ubiquitous virtualization technology provider on Nov. 22, 2023, triggered abrupt and pervasive changes, impacting everything from product to pricing.

Less than a month after the deal closed, Broadcom ended perpetual licenses in favor of a subscription-based billing model and announced a drastic overhaul to the VMware portfolio.

The decision reverberated across the enterprise IT ecosystem, where roughly 80% of organizations use VMware infrastructure products, Forrester Principal Analyst Naveen Chhabra said.

VMware customers, which number around 375,000 globally, characterized the changes as a once-in-a-decade disruption to enterprise IT infrastructure, operations and budget, according to Gartner. As time ticked down on existing VMware licenses support, enterprises braced for costs to at least double and, in some cases, spike fivefold, the analyst firm reported.

The transition marked a seismic shift in enterprise IT. Sure, generative AI has caused its fair share of disruption, but the technology has yet to scale. The acquisition of VMware, however, and the ensuing licensing changes has threatened to upend core infrastructure, disrupt critical business processes and wreak havoc on spending.

VMware costs and corresponding increases vary across the customer base, Scott Bickley, practice lead and principal research director at Info-Tech Research Group, told CIO Dive. “Depending on the VMware products in use, the typical price increase ranges from 2x to 12x,” he said.

Budgets weren’t the only concern. Under the banner of simplification, Broadcom radically pared VMware down to two primary offerings: the VMware Cloud Foundation private cloud stack and the smaller VMware vSphere Foundation virtualization platform.

In the blink of an eye, customers accustomed to selecting solutions from an a la carte menu of nearly 170 software packages and thousands of stock-keeping-unit pricing options were faced with a virtual fork in the road — VCF or vSphere.

“People built plans and whole ecosystems around this product set assuming it would never change,” Mike Cisek, VP analyst at Gartner, told CIO Dive.

“There was a visceral emotional reaction to what was happening because their whole world was being pulled out from underneath them," Cisek said. "SKUs just vanished overnight.”

The immediate backlash was profound. Customers who’d neglected to renew licenses ahead of the acquisition — which Gartner said represented roughly 50% of VMware’s midmarket base — bristled at implications of the Broadcom bundles.

Forrester fielded so many VMware inquiries that it created a Teams channel devoted solely to the topic, Tracy Woo, principal analyst at the firm, said.

Woo characterized Broadcom’s strategy as an effort to divorce the customer. “They've made these wildly insane price increases in the name of saying either you pay us what we want or you're out of here,” she said.

Gartner saw inquiries about VMware options spike by 275% year over year during the first six months of 2024. The firm expects half of the customer base to initiate proofs of concept for VMware replacements in the next two years and nearly one-third to switch to alternative hypervisor and container platform solutions by 2028.

Virtualization realities

As the changes sunk in, customers cycled through five stages of budgeting grief, slipping from anger and denial into the bargaining phase before moving on to depression and ultimately an uneasy kind of acceptance.

One large VMware customer, however, took Broadcom to court.

AT&T filed suit against Broadcom over a VMware licensing disagreement in August, alleging it was being bullied into subscribing to products it did not need. The telecommunications giant sought to extend support services based on prior, pre-acquisition contractual terms.

Broadcom fired back in court, noting VMware provided customers with advance notice of a long-planned business model transition, claiming AT&T had indicated its intention to find another provider. Broadcom agreed to temporarily extend product support but objected to AT&T’s broader demands.

AT&T EVP and GM of Wireline Transformation and Global Supply Chain Susan Johnson said in an August email addressed to Broadcom CEO Hock Tan that the impasse stemmed from a looming 1,050% increase in its VMware bill.

She also said migrating to an alternate solution could cost as much as $50 million.

The two parties notified the New York State Supreme Court in mid October that they were working toward a settlement and signaled that they’d reached an agreement on Nov. 21. The court gave the two parties until Dec. 13 to finalize terms.

“The tragedy of it is that it's not as if you couldn't see this coming,” Info-Tech’s Bickley said. “You knew the price was going up, that things were going to change and that Broadcom was not easy to negotiate with.”

Size matters

While each VMware customer is contending with unique infrastructure needs and vendor issues, the AT&T situation illustrates the complicated nature of IT dependencies.

VMware, which commanded 97% of the virtualization software market revenue prior to the merger, remains too deeply embedded in IT ecosystems to simply abandon, according to Gartner.

The technology continues to earn positive ratings from the firm, despite customer unease over the acquisition — and the price tag.

“When CIOs look at these renewals, they see $40,000 turn into $400,000, $1 million turn into $10 million, and they can no longer justify the cost based on the service it provides to the organization,” Cisek said. “It’s not that it's a bad product, it's just that it’s no longer viable financially.”

The larger the company, the deeper the dependency. AT&T, for example, said it has 75,000 VMware virtual machines running across approximately 8,600 servers. Some of those deployments support critical workloads, including a federal wireless first-responder communications network, the company said in an affidavit.

Many customers spent a decade or more building operational environments around VMware solutions. An impulsive shift away from the provider would be fraught with risk and rife with IT disruptions.

“When you get to global enterprise options, you really don't have a lot of choices except to negotiate and then consolidate, standardize, rationalize or shrink it as much as you can to ease the pain,” Cisek said. “The cost associated with migration is too great and the viable alternatives are few and far between.”

While no one is fully shielded from the implications of VMware’s shifting business model, not all organizations are impacted equally. In software, simplification is often code for bundling, a practice that can create efficiencies and even cost savings.

Broadcom is pushing customers to the full-stack, private-cloud VCF solution, Rick Vanover, VP of product strategy at Veeam, said.

The software company, which got its start with a backup solution for VMware in the mid-2000s, saw its VMware costs increase by 300%, according to Vanover. He’s seen three distinct customer profiles emerge in the last year:

- Enterprises that had already bought into the full-stack solution and intend to stay put.

- Organizations with more than one hypervisor solution that want to shift some workloads away from VMware.

- Companies that rely solely on VMware for virtualization capabilities and are looking for a quick exit strategy to avoid the steep cost of renewal.

Analysts agree. There’s a top tier of users who stand to gain from the bundled offerings, according to Bickley.

“VMware customers who were already all in on VCF are finding the renewal process to be refreshingly low-key, yielding price decreases in some cases,” Bickley said. “We are seeing renewals that are flat or even slightly less expensive than the previous term's pricing due to the bundled discounting in VCF.”

Broadcom cut the cost of VCF in half with the subscription bundle, reducing the price to $350 per core annually, VCF Division VP of Product Marketing Prashanth Shenoy told CIO Dive.

“It was the business model shift from perpetual to subscription that caused all the angst in the market,” Shenoy said.

The company began moving toward a SaaS billing model prior to the acquisition but the pace quickened this year under the banner of product simplification. VMware doesn’t want to go back to offering nearly 9,000 SKUs, said Shenoy. “We want to truly focus our R&D innovations on the best possible platforms and services that our customers want,” he added.

The full-stack solution wasn't universally embraced.

“The disconnect comes for people who only use three products and now have to pay five or ten times as much for the bundle,” said Bickley.

Unemotional rescue

The Broadcom acquisition unleashed an initial wave of organizational anxiety followed by sticker shock. Emotional reactions to the changes threatened to eclipse the fundamental utility of VMware solutions.

“Broadcom unwantedly created this animosity — these strained relationships,” Forrester’s Chhabra said. When customers see their new contract terms, they get angry and then start seeking alternatives, he added.

Broadcom has extended several olive branches since the start of the year, but it hasn’t backed away from subscription bundling. The company took responsibility for creating unease among its customers and pledged to spend $1 billion on further product innovations in a March blog authored by Tan.

“We are in no way saying it’s been an easy path for our customers,” Shenoy said. “The pace of change was pretty drastic, so we had to help our customers transition through that process.”

The decision process meant weighing bundled costs against potential alternatives to VMware. Shenoy saw that process unfold as the year went on.

“Pretty much every major customer who’s moved forward with us has evaluated other options,” he said. “They all come to the same conclusion: that moving off of VMware is a very long and laborious process and the end cost from a business perspective may not be well worth it. The functionalities and the capabilities that we've built for the last 20 years are not easily available in any of the competitive platforms out there.”

VMware also showed some flexibility under Broadcom as the year wore on. At the end of October, Broadcom announced two additional bundled offerings — VMware vSphere Enterprise Plus and VMware vSphere Standard.

“Customers wanted options, especially in the lower end of the market,” Shenoy said. “While we are heavily, intensely focused on simplification, we are also constantly listening to our customers and our partners and making the right changes as we move forward with our strategy.”

The company untethered the VMware Fusion and VMware Workstation hypervisors from the full-stack bundle earlier this month.

Broadcom executives have noted that bundled solutions and subscription billing are an industry standard, a reality that doesn’t bring down the bill or calm tempers.

“This is just the latest example of a software vendor that wants you to re-rent the same software you’ve already purchased,” Eric Helmer, SVP and CTO at Rimini Street, said. “It’s a way to get customers to pay again for software they’ve already bought … and that wasn’t the agreement. You purchased a perpetual license.”

For CIOs tasked with navigating past the pain points, keeping emotions in check is paramount.

“The way to do this is to roll up your sleeves and do the hard work of reviewing each feature and function that you need, looking at options and pressing the pencil to it to figure out what’s going to make sense over the next five years of total cost ownership,” Helmer said. “If you’re going to use every single functionality of that bundle and the ROI can be justified, then that’s what you should do.”

Managing C-suite discord may also fall under the CIO’s purview, as news of the price hikes and licensing changes spreads to other executives.

“CIOs need to be the voice of reason and take the emotion out of it, to allow their organizations to plan for the future in the most effective long-term manner, even though they might take some short-term bruises from the CFO and some of the stakeholders in the organization,” Bickley said. “It kind of comes with the territory on this one.”

A middle-ground solution that keeps the lights on while optimizing existing VMware deployments can help soften the blow. Forrester recommends customers trim their deployments as they weigh VMware alternatives. The aim is to reduce costs today while vetting exit strategies.

“You don’t need to be moving away 100% to save money,” Chhabra said. He added, “If migration was so easy, Broadcom wouldn’t have invested $61 billion in VMware.”

Broadcom remains committed to building VCF into a fully integrated platform solution that can function as a private-cloud alternative to hyperscaler infrastructure.

“The future of the enterprise — your enterprises — is private cloud, private AI fueled by your own private data,” Tan said in August during a VMware Explore conference keynote.

In the past year, Broadcom rolled out two VCF solution upgrades, AI capabilities in partnership with Nvidia and a more robust version of its Tanzu application development platform.

The goal is to make dozens of solutions work together as a cohesive platform.

“Our customers have gotten different components of this platform over the last several years, so they haven’t quite gotten that single consistent experience of making these products look, work, feel and act like one,” Shenoy said. “Our job right now is to truly clean up the seams around these products and make them look, feel, act and behave like a single private cloud platform.”