Dive Brief:

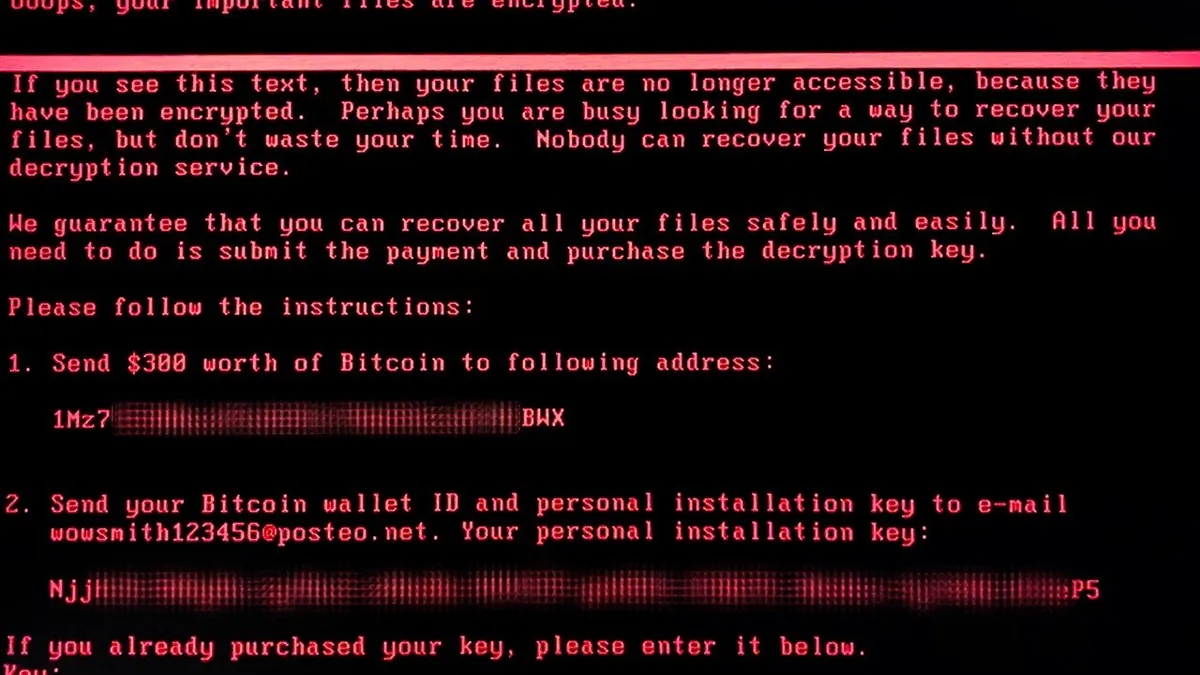

- Apple, Aon, Allianz and Cisco launched a "holistic" cybersecurity solution combining cyber insurance coverage, resilience evaluation and secure technology to help businesses stave off ransomware and malware threats, according to an Apple announcement.

- Customers will have access to response team services should a cyberincident occur, insurance perks such as potentially lower insurance deductibles and protection of email, endpoint and internet safegaurds.

- By 2022, the global cyber insurance market is expected to reach $14 billion, with the most growth taking place in North America, according to Allied Market Research. North America is expected to lead the market during this time, though the European cyber insurance market is expected to grow the most rapidly.

Dive Insight:

As cyberattacks and data breaches continue to hit businesses, the topic of cyber insurance is being approached for the first time by more boards and IT decision makers. The liability of a potential data breach of PII is too great for many companies to avoid getting insurance any longer.

Security as a Service hasn't quite hit its stride in the enterprise — that is, if it ever will — but the complexities and threats out there are simply too much for many organizations too handle.

Cyber insurance is only one part of a cybersecurity plan, and holistic solutions that bring together insurance, technology and security services stand to earn the interest of organizations without robust security teams. Unified, outsourced security tools certainly hold something over a hodge podge of disparate proprietary systems.

For the technology companies, this coupled solution creates a new foothold to spread Apple's devices and Cisco's ransomware detection to more enterprise customers. Tying security plans to a single brand of devices may prove tricky, however, as employees continue to BYOD and increase personal endpoints on company networks.