Dive Brief:

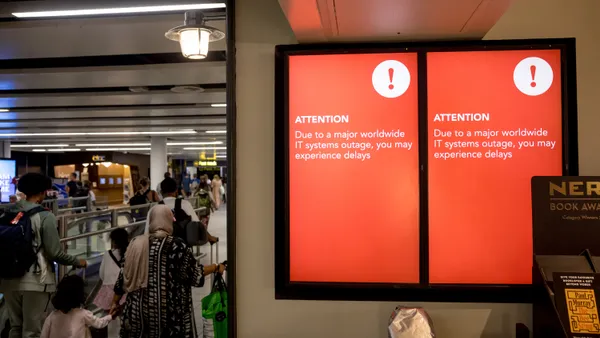

- The June 27 Nyetya cyberattack cost A.P. Moller – Maersk (Maersk Group) $250 to $300 million, CEO Soren Skou said during an earnings call with investors on Tuesday.

- Maersk Line was hit hard, recording a $220 million net operating profit/loss after tax (NOPAT). "Had we not (had) the cyberattack, Maersk Line would have made a delivery in the NOPAT in the range of $450 million to $500 million for the quarter, consistent with almost 10% return on the invested capital," said Skou.

- It was the group's Damco unit that was hit the hardest, however. The freight forwarder saw revenues increase by 8.3% year-over-year (YoY), but its NOPAT fell 140% to a loss of $6 million. APM Terminals was also affected by the attack, but more marginally.

Dive Insight:

The earnings report reveals key details about just how a cyberattack in June can ripple to raise unit and operating costs, and ultimately damage a company's bottom line.

"We could frankly have explained everything in the quarter with the cyber-attack and ripples from that. But as a management team, we believe we can do a better job than we did in the third quarter," said Skou, referencing rises in unit costs, a loss of reliability and lower volumes in Q3.

The Nyetya attack — which shut down select Maersk Group operations across the world from late June to mid-August — was blamed for a 2.5% decline in Maersk Line volumes, a 3.9% increase in fixed bunker prices, increased desert times due to lower invoicing times, higher terminal cost, higher positioning costs and higher SG&A costs.

Speaking to the operational expenses, Maersk Line Chief Commercial Officer said the lower volumes were a result of customers diverting their bookings during the two-week period after the cyberattack. Higher costs were borne from operational expenses like deploying extra vessels to manage "cargo contingencies," he said.

Skou adds the group also suffered multiple days of "down time" at its fully automated terminal in Rotterdam, and some disruptions at their terminals in New York and Los Angeles. Meanwhile, Damco suffered an opportunity cost as it was unable to participate in the spot market after the attack, a time at which spot market rates were high.

"The recovery has been gradual throughout the third quarter and we got into the fourth quarter," said Clerc. "With respect to cost, there may be some lingering effects that we are still working on." But, Clerc expects both revenue and costs to normalize during the fourth quarter.

After all, Maersk Line was still able to turn a profit despite the disruption, largely due to strong market fundamentals.

"This performance was driven mainly by higher freight rates, because our volumes were actually down 2.4% year-on-year," said Clerc. "And the freight rates were driven by the strong fundamentals that Soren mentioned with 5% growth on demand and only 3% growth in total nominal supply."

As a result, the company is still optimistic despite adjusting its guidance to $1 billion, as opposed to "more than $1 billion."